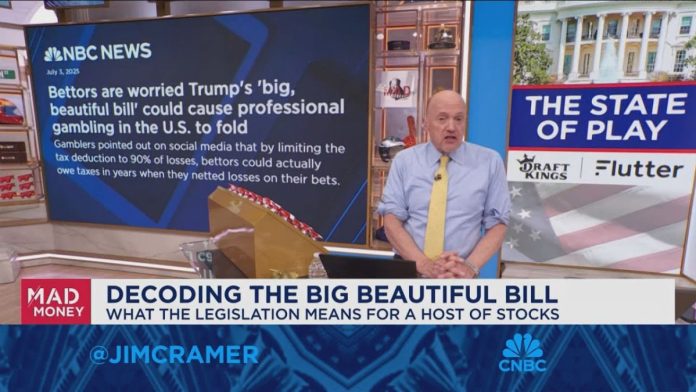

‘Mad Money’ TV host Jim Cramer has described the recent amendment to Big Beautiful Bill involving the gambling income tax as ‘brutal’ for the industry.

The change could spell trouble for both casual and professional gamblers in the country following the senate’s change to president Donald Trump’s bill.

It is said to make the process of generating profit from gambling far tougher; the deductions to gambling winnings will (under the Senate’s version of the bill) be limited to 90 percent of losses.

Speaking on CNBC Television, Cramer spoke about the recent taxation changes coming out for gambling income and how they could hurt gambling stocks like DraftKings.

“Even though the new rules are clear, it isn’t obvious how it will play out,” Cramer began. “It is a change in the way gambling income is taxed; under the current law you have to pay taxes when you’re gambling winnings. If you’re gambling losses, you can deduct them for your winnings.

“So you’re only way paying taxes on your net winnings, the same way we do it in the stock market. If you win $1000 betting but also lose $1000 you don’t pay any tax because you didn’t make any money. Starting next year, that’s about to change.

‘You’ll still play taxes when gambling winnings, you’ll only be able to deduct 90% of your gambling losses. In the same example, you’ll only be able to deduct $900 in losses, meaning you have to taxes on the remaining $100 – which I think is brutal!”

Professional gambler warns wide-spread effects on gambling industry in US

Professional poker player Phil Galfond, who plays on BetRiversPoker, took to social media to break down the current situation, claiming that you could pay more in tax than you won and that it could also hurt casual gamblers as well. “This is really bad,” he began.

“If you’re a professional gambler or recreational – but especially professional – and even if you are an operator in this area it is quite scary. You could pay more tax than you made during the year and that is completely untenable – you can’t be a professional gambler in the US if this goes through.

“That will have a ripple effect on industries that depend on professionals – the Poker industry, the DFS do. This will impact all the players and the industries.”

Who could benefit?

While the players themselves are the ones who would struggle under the new bill, those tax laws that will drive them away from the business of gambling is good for the purveyors of gambling, given it will reduce the herd of those who are more likely to win, leaving them with casual gamblers more likely to lose.

Whether or not the bill officially passes remains to be seen, but if it does, it will likely scare off those who are smart enough to consistently best the bookmakers by winning more than they lose.