The increased adoption of crypto payments in igaming can help to improve transparency and trust in the vertical according to industry experts.

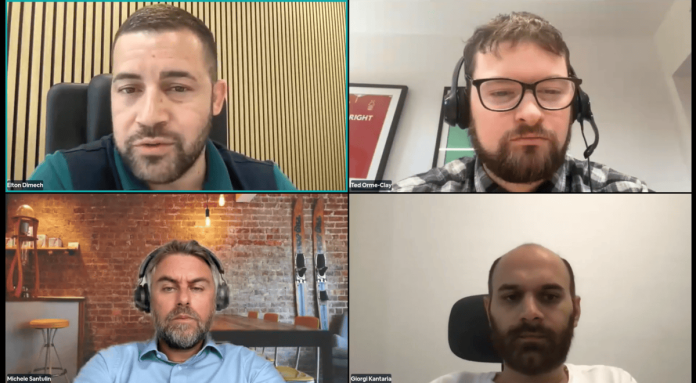

Appearing on the latest SBC Webinar, titled ‘Payhound: Crypto for igaming operators, challenges and navigating regulation’, FortuneJack’s Chief Operating Officer, Giorgi Kantaria, explained how the initial intention of crypto as a transparent form of currency can increase trust between operators and players in igaming.

He said: “When you’re in Bitcoin, gambling or entertainment it always comes down to trust and transparency. In blockchain, the main idea was about transparency. You can check and track everything point-by-point and case-by-case.”

Michele Santulin, Chainanalysis’ Regional Director of the Mediterranean Area, was also present on the panel and suggested that there could be other benefits to blockchain payments transparency from a business analysis perspective.

“The possibility to trace funds will not only be a support for compliance reasons, but it will also be important for business analytics,” he explained.

“What you can provide today, for example, to igaming platforms is information on what players and customers have done outside of the platform. We’re capable of understanding how many funds the customer has from the wallet for which they interacted with the platform, or we can understand if this customer is interacting also with other igaming platforms because the transfer of a blockchain gives you the ability to have this view.

“It’s a new way of enhancing the knowledge of your customers. Typically you have your CRM which gives you information on your customer through what the customer does with you. Now having this view, the possibility is to see what the customer is doing outside of your platform and in relation to your business.”

He finished by saying that this will allow operators to address the specific marketing campaigns to customers based on this outside knowledge.

Also on the agenda during the wide-ranging discussion was the regulatory challenges operators face when using crypto payments methods, including a discussion around anti-money laundering concerns.

Incoming regulatory changes, particularly how operators can navigate the complexities of the European Union’s (EU) upcoming Markets in Crypto-Assets Regulation (MiCA), were also on the agenda.

You can register to watch the full webinar here.